Mutual Funds Customers Segmentation

Perform Customer Segmentation studies with Data Science

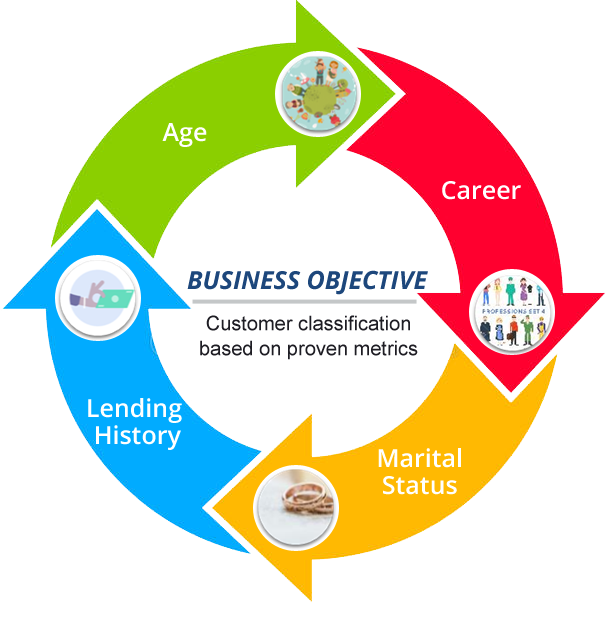

Building a customer classification model to improve bank decision-making process through customer prioritization for mutual fund subscription potential.

Business Objective

Scope of Functionality

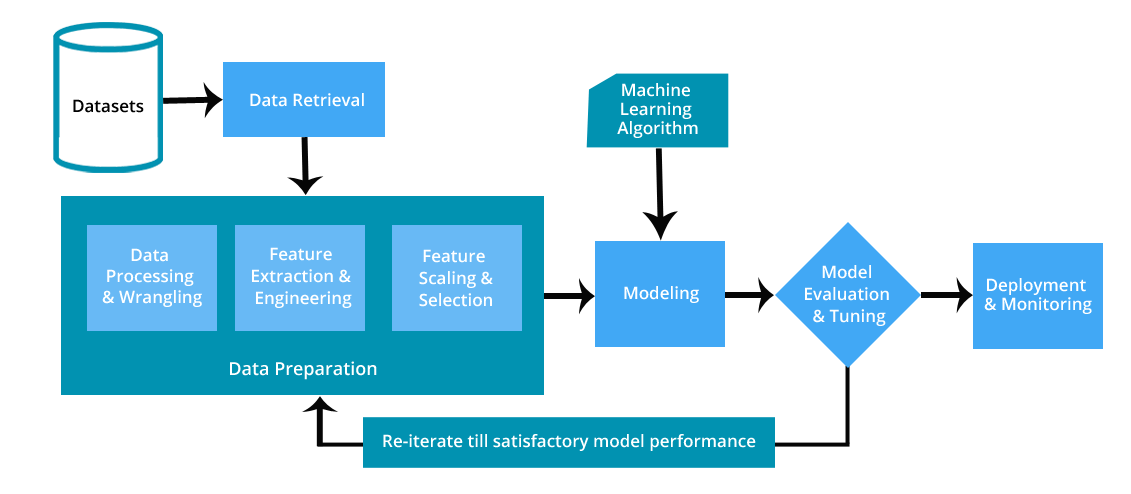

Data Science techniques sequentially applied to customer data harvested from the Lloyds Bank’s direct marketing campaign to improve customer identification & classification (KYC) and provide accuracy to segment-specific marketing efforts.

Recommendation analytics applied on the financial institute’s data by applying sophisticated algorithmic techniques to mine patterns and insights from the raw data on financial transactions, demographic factors, and scheme level features, to develop responsive cross-sell and up-sell strategies.

Clustering analysis applied on the entire data universe carried out to find natural groupings within the data and homogenize raw investor clouds into predictable groupings.

Unsupervised learning techniques, such as associations rule learning and clustering algorithms that make no assumptions about target data applied to allow the data mining algorithm to find associations & clusters in the data independent of any pre-defined objective.

Apply Data Science techniques to Customer Segmentation data to accurately and intuitively match the local demand for banking services to corresponding segments of the population determined by customer data classification characteristics.

Leverage big data analytics platforms for the analysis of areas such as growth in the net assets under management and customer acquisition & retention to improve prediction and optimization strategies and develop investor-specific recommendations

Credit Cards

Promote Customer Centricity through Machine Learning

Risk Assessment

- Timely, accurate assessment of Credit Worthiness is vital as credit card applicants dislike the uncertainty around their applications.

- With the growing volume and variety of data, machine learning algorithms can be more useful, enabling lenders to dynamically include additional sources

- These sources could be as varied as current wealth, property ownership, insurance claims, social network profile and other personal indicators, thereby, creating a more holistic profile of the borrower.

Fraud Detection

- Issuers bore more than 70% of the losses arising from global card fraud in 2018.

- Machine learning systems feeding on historical transaction & behavior data can help identify patterns associated with fraud.

- This gives issuers a better chance to counter the ever evolving sophistication of cyber-attacks, compared to traditional rule based techniques.

Better Customer Care

- The advancements in machine learning are helping Natural Language Processing (NLP) applications such as chatbots become more contextual.

- Through chatbots, credit card issuers can ensure round the clock assistance across all stages of customer interaction including product selection, on-boarding, payments and usage.

- Smarter chatbots can also learn to detect irate human behavior and accordingly escalate queries to customer care executives.

Acquisition & Retention

- Consumers today have a problem of too many credit card options to choose from.

- Credit Card Issuers can feed first and third party data to machine learning systems to come up with a target audience profile and the relevant channels to share most appropriate card options.

- The same principle can also be applied to timely target disgruntled customers & reduce churn.

Personalized Rewards

- Rewards are most important reasons for keeping a credit card on top of the wallet.

- Machine learning can help issuing banks get a true understanding of each customer and follow it up with tailored reward experiences.

- American Express uses machine learning to recommend restaurants to its card members.

- HSBC is experimenting with predicting how likely customers are to use their reward points & accordingly market its reward programs more effectively.